i've linked an oxdown post to the header, (and here,) by massacio about our financial crisis and specifically, credit default swaps. it is a complicated post, just as it is an especially difficult and complicated issue. that said, i wanted to share my interpretation.

with credit default swaps we had gamblers, (protection buyers and sellers,) betting on publicly traded companies. in gambling one usually expects there to be losers but in this case, it seems henry paulson and ben bernanke are using my ira to pay the losers off.

what massacio points out in the oxdown post is that paulson and bernanke took the bailout money but no one knows how they are spending it. it seems aig and citigroup should have went under, but they did not. what the heck is going on?

i get the feeling the bailout money is being funnelled to entities like citigroup but not affectng their bottom lines because in turn, they are paying off their protection buyers, (on the downlow.)

this is why we the people should be opposed to the financial bailout, because there is no accountability and no transparency and because citigroup should have failed and those who traded in credit default swaps through citigroup should have simply lost.

as it is paulson was in china last week begging their government not to devalue the dollar, despite the fact we're printing money like crazy without any backing. so here is how all this is currently working.

- our treasury prints money.

- our politicians hand the money to the banks as if it is blessed by the american people, (which it is not.)

- the banks skulk around trying to pay off their gambling debts in order to stay afloat all the while trying to keep the wizard of oz's curtain drawn so we cannot see them back there.

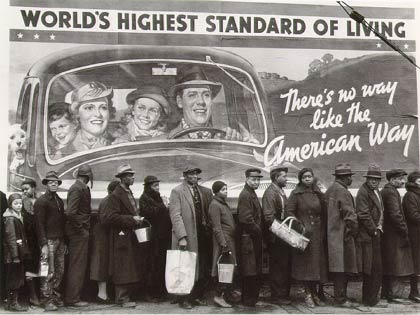

- the american people just go about their daily business without any clue as to the horrifying crisis they will pay later for not paying attention today.

i guess sometime in the summer of '09 we will all wake up one day to discover the american dollaw has either been replaced or devalued by 50%. this is to say each and every dollar, wherever it may be, will suddenly be worth 50-cents. or, put another way, prices on virtually everything will double over night. milk will be $5 per gallon. gas will jump back up to $4 per gallon, (assuming no fluctuation in the interim.) one dozen eggs will also approach $4. put another way, everything in the consumer price index will double. over night.

how will that affect your family?

1 comment:

My post is fairly complicated, in part because it builds on earlier posts, explaining some of the background. You can see all of my diaries by clicking on my name in the post. You might want to look at this one first: http://oxdown.firedoglake.com/diary/1752

It explains the AIG situation and I hope it is fairly clear.

Others on the subject explain the situation a bit more.

You should be aware that some of the participants in the CDS market are using them to hedge the risk of holding securities or loans into the reference entity. This seems like a reasonable thing to do, and I distinguish this from the gambling transactions.

The

Post a Comment